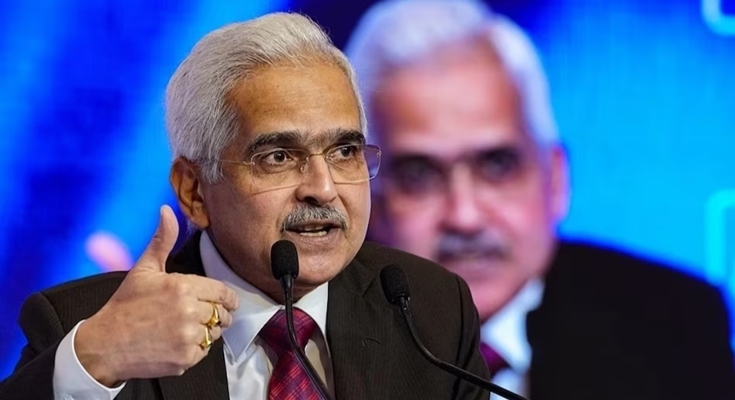

RBI monetary policy live: The results of the Monetary Policy Committee meeting of the Reserve Bank of India (RBI) (MPC Meeting Results) have been announced. While explaining the decisions taken in the meeting, Reserve Bank of India Governor Shaktikanta Das said that this time also no change has been made in the repo rate, that is, these rates have been kept constant at 6.5 percent. This means that there is going to be no change in your EMI. Five out of six members present in the meeting were in favor of keeping the repo rate unchanged.

Repo rate remains the same from February 2023

The Reserve Bank of India (RBI) last increased the repo rate on February 8, 2023 last year. Then RBI increased it by 25 basis points or 0.25 percent to 6.5 percent. Since then, these rates have been kept unchanged in six consecutive MPC meetings and this time too it was already expected that there would be no change in it. Along with the repo rate, the Reserve Bank has kept the reverse repo rate constant at 3.35%. MSF rate and bank rate will remain at 6.75%. Whereas, the SDF rate is stable at 6.25%.

RBI monetary policy live: GDP growth expected to be 7%

RBI monetary policy live: Along with the announcement of keeping the repo rate stable, RBI Governor Shaktidans Kant said regarding inflation that the Monetary Policy Committee is keeping an eye on the prices of food items (Food Inflation). There is a slowdown in inflation. In view of this, the inflation target has been maintained at 4 percent in the MPC meeting. Regarding GDP growth, Shaktikanta Das said that India’s real GDP growth estimate in FY24 has been kept above 7 percent. Even in the earlier estimates, the Reserve Bank had kept it at 7.3 percent. Along with this, he said that demand is continuously showing strength in the rural sector.

The retail inflation rate for FY25 is estimated at 4.5%. Whereas the retail inflation estimate for FY24 has been maintained at 5.4%. Apart from this, RBI has increased the GDP growth estimate for the first quarter of the financial year 2025 from 6.7 to 7.2%. Whereas in the second quarter the GDP estimate has been increased from 6.5% to 6.8%. It has been increased from 6.4% to 7% in the third quarter and 6.9% in the fourth quarter.

This is how repo rate affects EMI

RBI monetary policy live: Repo rate is the rate at which the central bank of a country lends money to commercial banks in case of any shortage of funds. Repo rate is actually used by monetary authorities to control inflation. In fact, the effect of repo rate is seen on the EMI of loans taken by common people from banks. If there is a cut in the repo rate then the EMI of home and car loan of common people decreases and if the repo rate increases then the prices of car and home loan increase.

The country’s economy is strong

Shaktikanta Das further said that there has been stability in the Indian currency for the last one year and it will remain so in future also. He said that there is a need to be alert on new shocks related to the supply chain. Headline inflation this year remains high with considerable volatility and the 4% target has not yet been achieved. However, amidst uncertainty at the global level, the country’s economy is showing strength. He said that the country’s economic growth is accelerating and it is ahead of most forecasts.